Overview Ethiopia Construction Industry

The Ethiopia construction industry is experiencing accelerating growth, transforming the nation’s infrastructure and economy. With significant investments in a range of projects, Ethiopia’s construction sector is poised to become a key driver of development.

Ethiopia is home to about 130 million people, a figure which is growing at about 2.5% per year. The IMF projects GDP to reach $205 billion in 2024, making Ethiopia the largest economy in East Africa. GDP growth is expected to reach 6.2% in 2024 and 6.5% in 2025. Though debt to GDP stands at a relatively manageable 38%, the country’s dual exchange rate system with an official and a black-market rate is complicating business exchange with the rest of the world.

Ethiopia Construction Project Pipeline and Regional Comparison

Ethiopia is home to 143 large upcoming and ongoing construction projects. 40 of these projects are currently in various planning stages, while 103 are under construction. Among the largest upcoming projects are the $5 billion Bishoftu Airport, the strategically important $1.5 billion Ayisha Berbera Port Railway, and the $470 million Ethiopian Electric Power Headquarters. The Ethiopia National Housing Program is the largest ongoing (masterplan) project, followed by the nearly completed Grand Ethiopian Renaissance Dam (GERD).

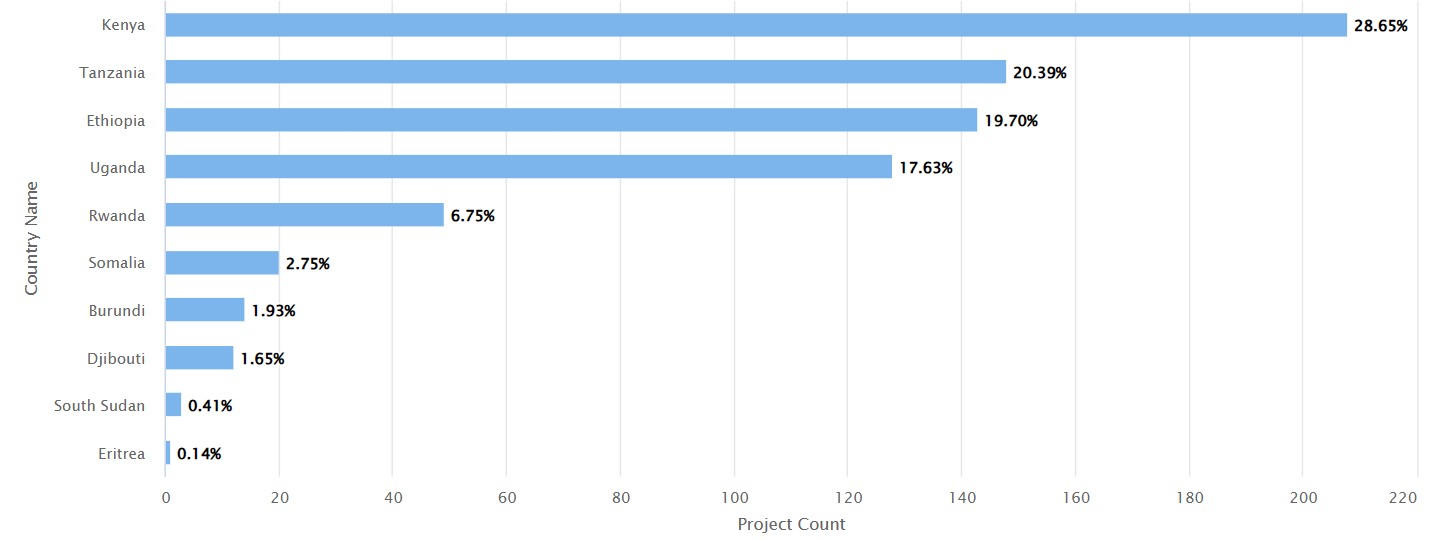

Within East Africa, Ethiopia is the third largest project market behind Tanzania and Kenya.

Ethiopia Construction Projects – Sectoral Activity

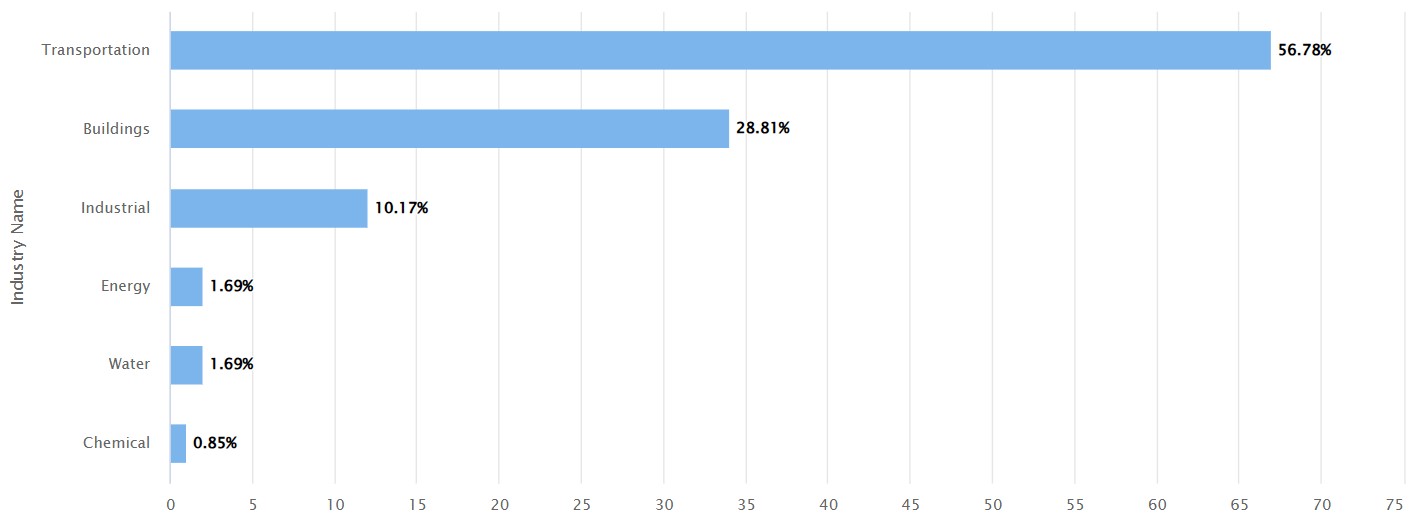

The project landscape in Ethiopia is driven by public investments and government projects. Most of the country’s leading developers are government entities such as the Ethiopia Roads Authority and the Ethiopian Electric Power Corporation. More than half of all large projects are investments in transport infrastructure, though these only represent 15% of the total project value. Building projects represent slightly less than one-third of all projects but 64% of their total value. Industrial projects (metals, cement) represent 10% of all projects, while energy projects account for 11% of the total value of projects.

Leading Contractors

Chinese contractors enjoy a relatively strong standing in Ethiopia. CCECC Ethiopia is the leading contractor by number of large projects, while several other Chinese firms are also represented in the top 10. Ethiopian entities such as publicly owned Ethiopia Construction Works Corporation, as well as privately owned Sunshine Construction also rank in the top spots.

Way ahead for Ethiopia – and you, our reader

Ethiopia is well-positioned to deliver significant opportunities to local, regional, and global suppliers. Macroeconomic prospects are positive and several large projects are already in planning.

If you would like to learn more about topics such as infrastructure projects in Africa, the 1000 large building projects in Africa, or projects in Africa’s power sector, have a look at our blog. To explore ABiQ’s huge database of construction projects in Africa and the Middle East, sign up for our Free Trial or let us show you our platform in a demo meeting.

If Ethiopia or Africa at large excite you as potential markets, but you do not know how to structure your market entry, get in touch with our sister company, africon GmbH.