Why should you care about infrastructure projects in Egypt?

Over recent years, the government has invested heavily in infrastructure projects in Egypt. While these projects present valuable opportunities for local, regional, and international suppliers, the industry also has its challenges. In this article, we will look at the driving forces behind the large infrastructure projects in Egypt and provide some examples of projects currently underway.

The key industry drivers

Egypt is a young and vibrant country. With a population of 116 million (2024), the country is the 3rd most populated on the African continent and the most populous in the Arab region (Worldometers). Its population growth of 1.75% per year means it adds 2 million people, the population of a city such as Vienna or Brussels each year.

The median age in Egypt is only 24 years, 14 years less than in countries like China or the United States. Consequently, the Egyptian labour force is growing rapidly. Egypt already ranks in the top 20 countries worldwide with the largest labour force (33 million people), recently overtaking France (32 million; World Bank).

The effects of this youthful population on infrastructure investment are twofold. Firstly, a larger working population, especially relative to the overall population, increases economic activity. This economic activity creates demand for more infrastructure. Secondly, the Egyptian economy and its government need to invest to drive job creation – not just after roads, railways, and waterways are completed, but also in the process of constructing them. To the government, infrastructure projects in Egypt therefor have a very high priority.

Government investment in infrastructure projects in Egypt

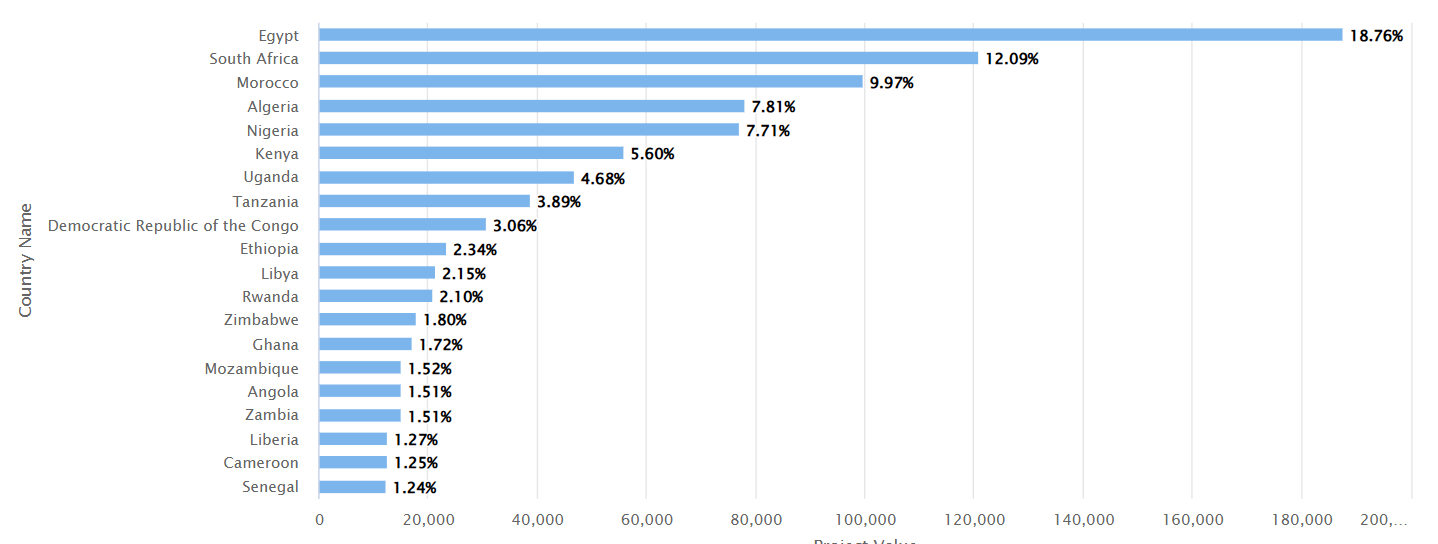

Investment into infrastructure projects in Egypt, especially by the Egyptian government, has been significant. As of 2024, Egypt is home to $85 billion worth of large, ongoing, and upcoming infrastructure projects. Total government projects stand even higher at $187 billion, the leading in Africa well ahead of South Africa ($120 billion).

Top 20 countries in Africa with the highest value of government projects

As a negative side effect, government debt has been growing at an alarming rate. In 2023, Egypt’s debt-to-GDP ratio stood at 96%, from 88.5% the year before. Together with a currency devaluation, this led to a debt crisis currently affecting the country.

To combat the short to medium-term effects of this crisis, Egypt has been relatively successful in securing international investments, especially from its Arab neighbours. The country has also been in discussions with the International Monetary Fund (IMF).

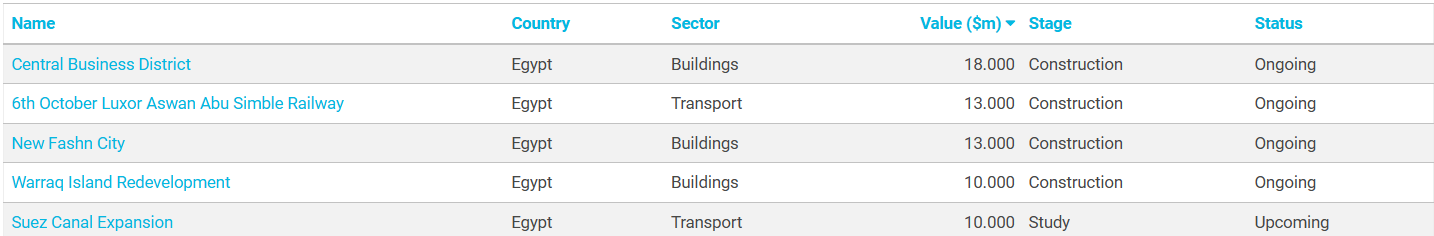

5 largest government projects in Egypt

Industry outlook

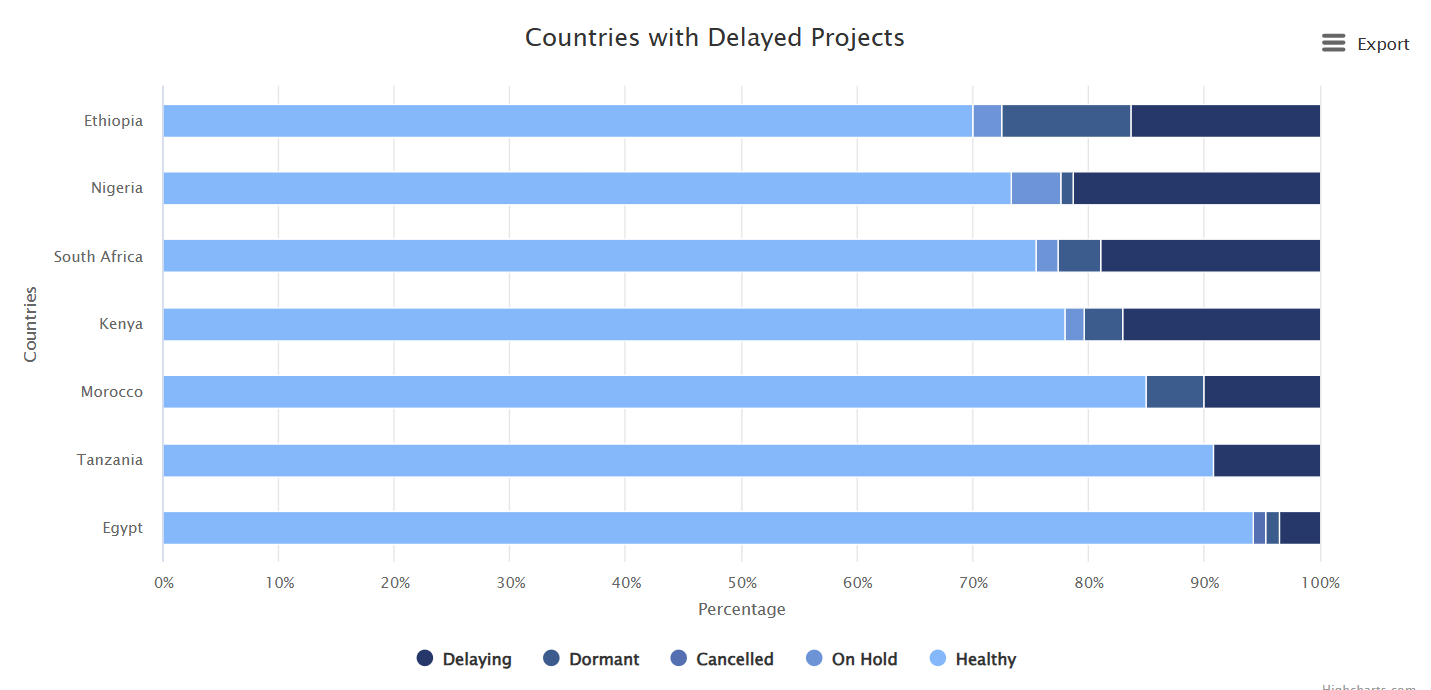

Despite recent debt challenges, there are no widespread delays or cancellations in Egyptian transport infrastructure projects so far. More than 90% of projects are roughly within set schedules. In other large African economies, this rate is significantly lower – for example, 70% in Ethiopia, 73% in Nigeria and 75% in South Africa.

Furthermore, medium to long-term prospects for the Egyptian economy are positive. Growth in 2022, before the current challenges emerged, stood at 6.7%. Despite a slowdown in 2024 (3%), the IMF predicts growth to accelerate again to 5.9% in 2029.

Total GDP in current USD grew from $294 billion in 2012 to $475 billion in 2022. In 2024, this number dropped to $347 billion, which still made Egypt Egypt the second-largest economy in Africa. The IMF projects a significant expansion to $539 billion by 2029, at which point the country will move to the number one position on the continent.

Similarly, in purchasing-power-parity, Egypt’s GDP per capita is expected to grow from almost $18,000 (#2 in North Africa) to more than $22,000 in 2029 (#1 in North Africa).

These key drivers represent a strong foundation for several of the ongoing and upcoming infrastructure projects in Egypt. In the following, we will look at some examples.

Largest currently ongoing transport infrastructure projects in Egypt

6th October Luxor Aswan Abu Simble Railway

Also known as the Express Electric Train Line 2, or the High Speed Rail Blue Line, this rail project is estimated to cost a total of $13 billion.

It calls for the construction of a 1,100 km high-speed railway running on the Western side of the Nile. It will begin from 6th of October City, West of Cairo, and run to Aswan at Egypt’s Southern border with Sudan. With 36 stations and a maximum speed of 250 km/h, the line is expected to transport about 3.4 million passengers per year.

The project is developed by the Egypt National Authority for Tunnels, as well as Egyptian National Railways. French companies Egis and Systra are supporting the project as managers. The contractor award was in 2021. Orascom, The Arab Contractors, Hassan Allam, and Siemens Mobility are the main contractors.

The project is scheduled for completion in 2027.

Gargoub Port

The Gargoub Port project calls for the development of a port, 70 km west of Masa Matruh City. The port includes the construction of a seaport, an economic zone, an industrial and logistics zone, and associated facilities. Additionally, the masterplan calls for the construction of an airport, a desalination plant, residential areas and energy facilities.

The developer of the project is the Egyptian Ministry of Transport. Contractors are Kased Khair General Supplies and Contracting, and Canal Harbor and Great Projects Company, a subsidiary of the Suez Canal Authority.

Construction started in 2015 and is expected to conclude in mid-2028.

Suez Canal Expansion

The Suez Canal is one of the main sources of foreign exchange for Egypt. The Suez Canal Expansion project aims to duplicate the canal’s navigational waterway (80km of canal) at a total cost of $10 billion. The current feasibility study is planned to last for 16 months.

The developer of the project is the Suez Canal Authority. Involved consultants are Dar Al Handasah and ACE Moharram Bakhoum.

Construction is scheduled to start in mid-2026 with completion expected in 2034.

More about infrastructure projects in Egypt – and beyond

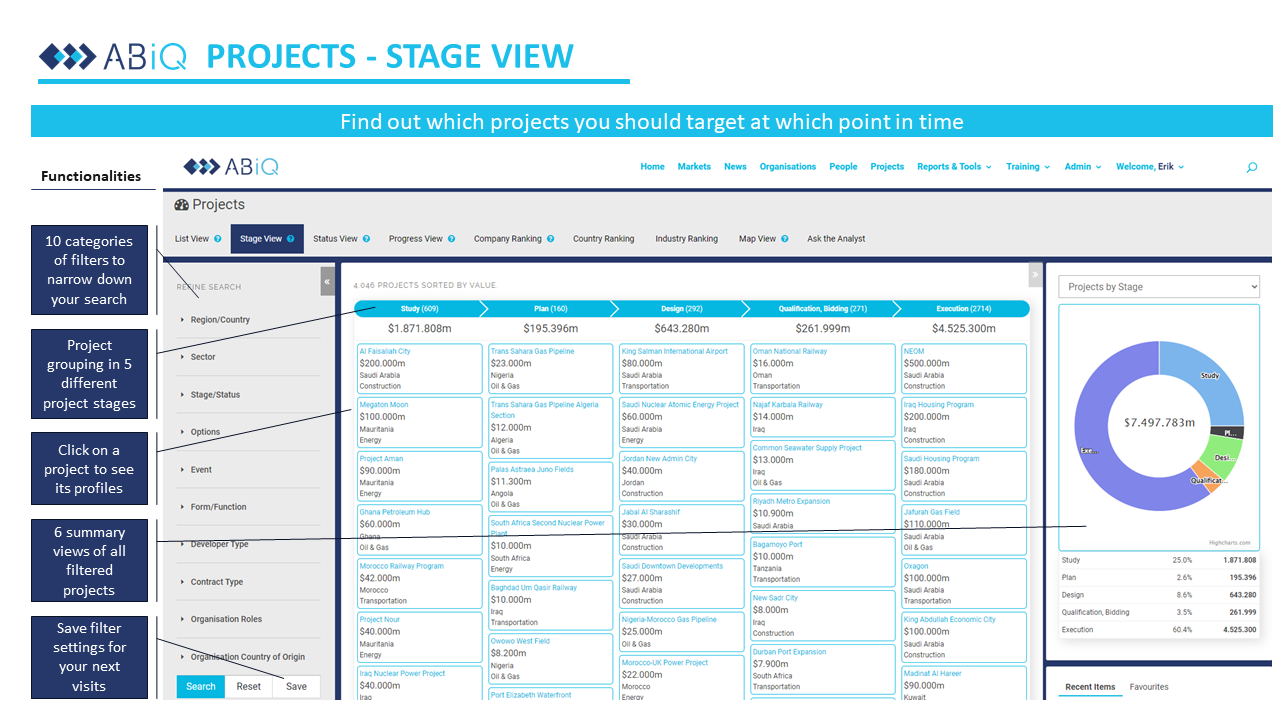

ABiQ’s live, online database gives you a comprehensive overview on upcoming and ongoing construction projects across Africa and the Middle East. In addition, we aggregate data to provide reports on country project risk (delaying projects), countries of origin of key project stakeholders, demand for key product categories, and many other factors.

To get a glimpse into our data, register for our Free Trial or request a demo. To read more articles like this one, head over to our blog.