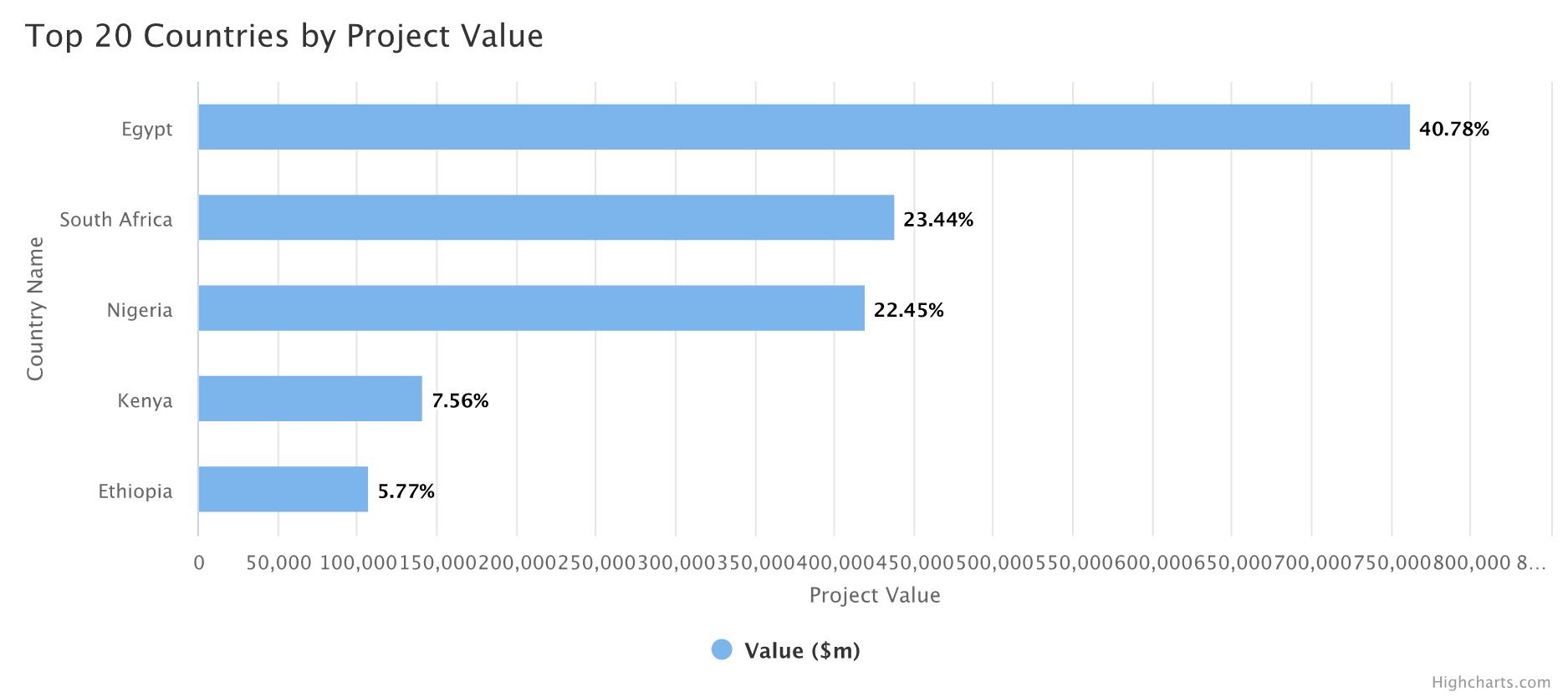

Unveiling Africa’s Construction Powerhouses: Key Contributors and Growth Trends

The construction sector in Africa is experiencing a dynamic surge, driven by rapid urbanization, infrastructure development, and strategic investments. As stakeholders navigate this evolving landscape, understanding the key countries contributing significantly to construction sector activity becomes paramount. Let’s explore into the numbers and unveil the construction powerhouses shaping Africa’s development trajectory.

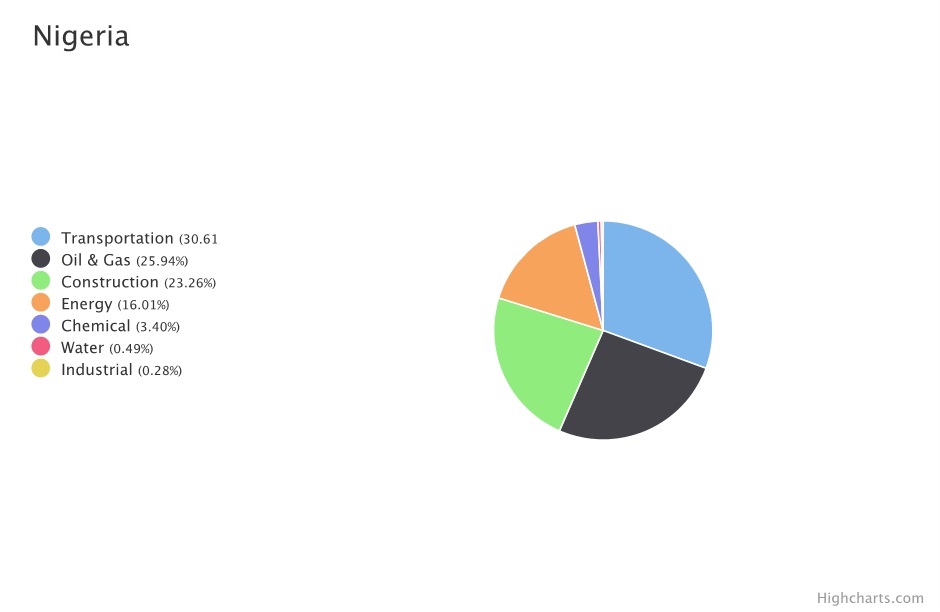

Nigeria: Driving Momentum with a CAGR of 2.4%

Nigeria emerges as a frontrunner, showcasing a robust market in the construction sector, which had a value of $40 billion in 2024 and is expected to grow to $45 billion by 2028. With a burgeoning population and increasing urbanization, the demand for residential, commercial, and infrastructure projects is at an all-time high. Nigeria’s proactive approach to infrastructure investments, particularly in transportation and energy, positions it as a key contributor to Africa’s construction boom.

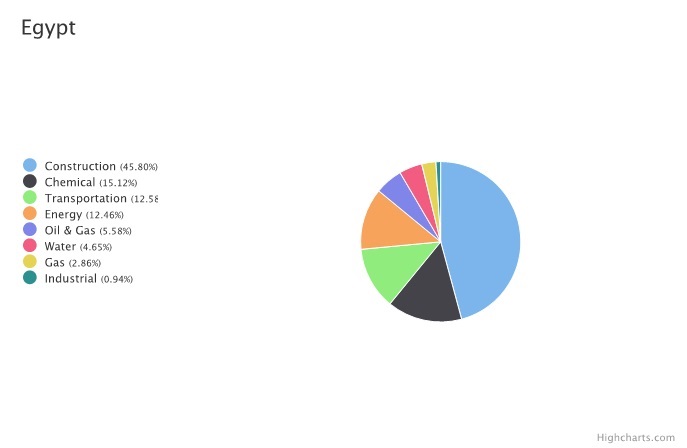

Egypt: Accelerating Growth with Investments and a CAGR of 8.4%

Egypt’s construction sector is rapidly growing, fuelled by strategic investments in infrastructure projects. With a market size of $51 billion and projected growth to $76 billion by 2028, Egypt stands out for its focus on enhancing transportation networks, energy facilities, and urban development initiatives. The country’s strategic location and favourable business environment continue to attract domestic and foreign investments, driving construction sector activity.

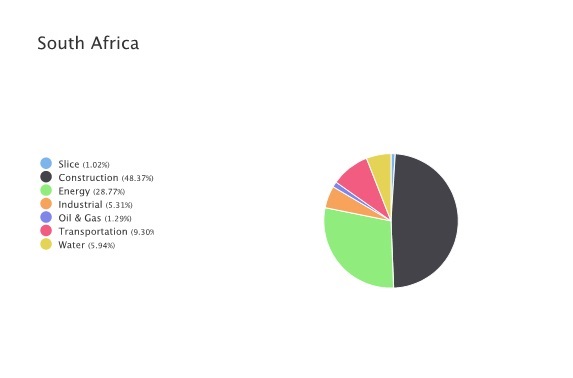

South Africa: Sustained Growth and Market Resilience with a CAGR of 3%

South Africa maintains its position as a construction powerhouse, showcasing sustained growth and market resilience. Despite economic challenges, the country’s diverse portfolio of projects, including commercial real estate and industrial developments, fuels a 3% growth rate in the construction sector by 2028. The current market size is $26 Billion and is expected to grow to $30 Billion by 2028. Investments in renewable energy, hospitality, and transport infrastructure further contribute to South Africa’s construction activity.

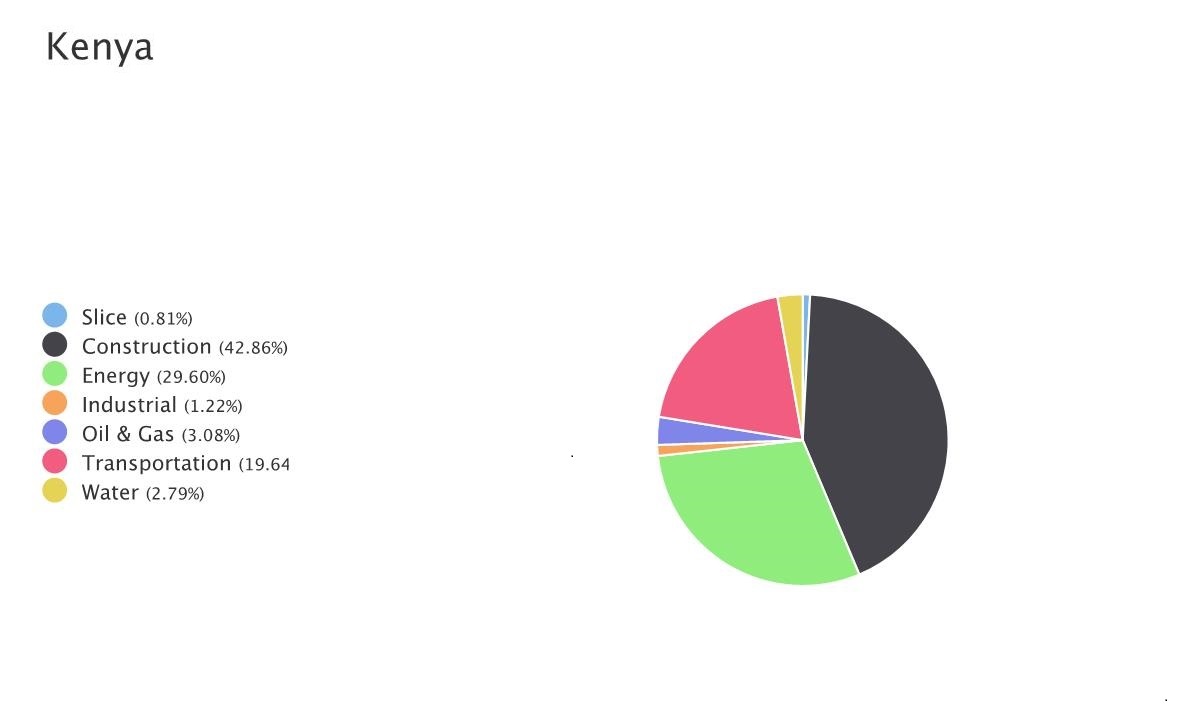

Kenya: Emerging as a Dynamic Construction Market and a CAGR of 7.1%

Kenya’s construction sector is witnessing exponential growth, propelled by infrastructure projects and rapid urbanization. With an impressive 7.1% compound annual growth rate, Kenya attracts investments in roads, railways, airports, and urban development initiatives. With a current market size of $17 Billion and expected growth to $24 Billion by 2028. The government’s commitment to enhancing connectivity and fostering business growth positions Kenya as a key player in Africa’s construction sector.

Ethiopia: Ambitious Agendas Driving Construction Growth and AAGR of 8%

Ethiopia’s construction sector is thriving, driven by ambitious development agendas and large-scale infrastructure projects. With a projected 8% average annual growth rate and a market size of $54 Billion, Ethiopia’s focus on attracting foreign direct investment (FDI) and fostering public-private partnerships (PPPs) is instrumental in sustaining construction sector activity. Projects like the Grand Ethiopian Renaissance Dam and industrial parks contribute significantly to Ethiopia’s construction landscape.

In conclusion, Nigeria, Egypt, South Africa, Kenya, and Ethiopia emerge as significant contributors to Africa’s construction sector activity, showcasing impressive growth rates and strategic investments. As Africa’s construction boom continues, these countries play pivotal roles in shaping the continent’s infrastructure development and economic progress.