Water projects in Africa and the Middle East – $143 billion in active investment projects

Clean water is one of mankind’s most crucial resources. While some African countries are capitalizing on an abundant supply, others, especially in North Africa and the Middle East, increasingly need to manage their water resources wisely. As a result, large-scale water projects in Africa and the Middle East are becoming a necessity to maintain public health and environmental protection.

Investment in Water Projects in Africa and the Middle East

As a result, Africa and the Middle East are heavily investing in water projects. As of 2024, the region is home to more than 300 large-scale water projects in Africa, worth $143 billion.

Stages of Water Projects

Currently, 42 water projects worth $29 billion are in the feasibility study stage. 80 projects are in various stages of planning and contractor bidding, while 189 projects are currently under construction.

Types of Water Projects

Wastewater treatment plants represent the largest share of water projects, with 115 projects worth more than $43 billion ongoing or upcoming. Water storage projects, mainly dams, follow with 80 projects valued at $45 billion. Additionally, several freshwater supply projects (58 projects, $35 billion), especially desalination plants, and water transmission projects (53 projects, $18 billion) are also underway in the region.

Leading Countries

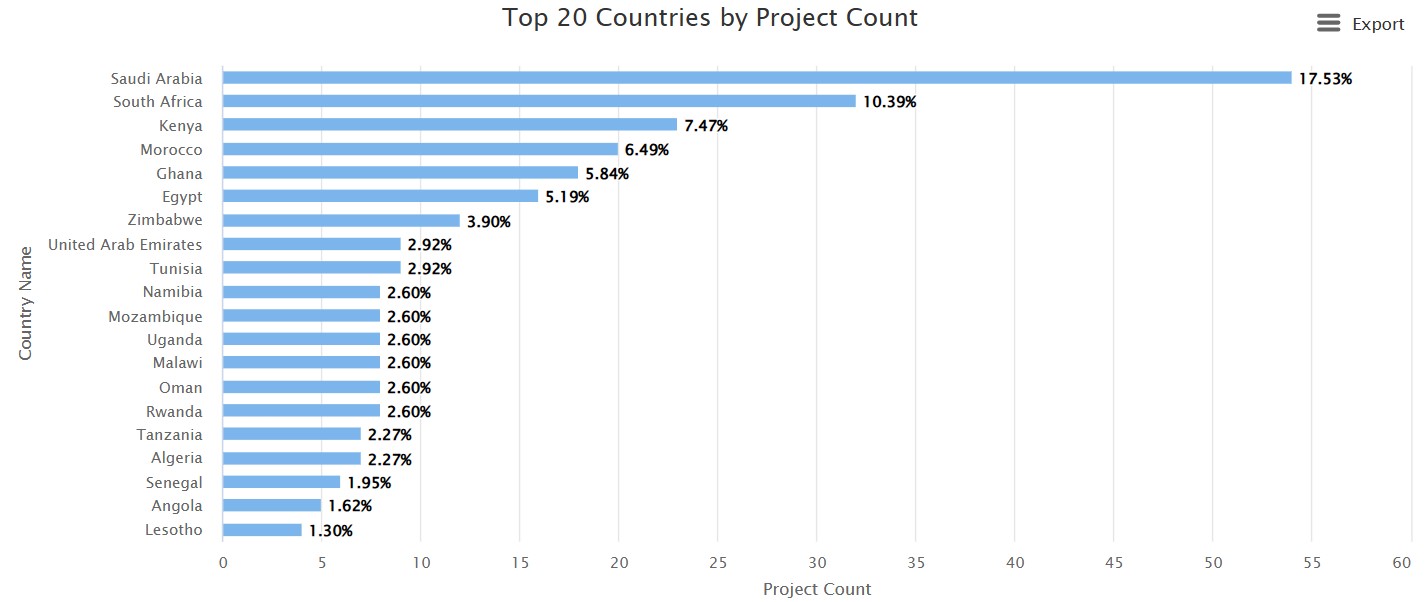

Overall, North Africa, South Africa, and the Middle East lead in value terms. Egypt, South Africa, and Saudi Arabia account for almost half of the total project value in the MEA region. Morocco and Qatar both add almost 10%. Kenya, as one of Sub-Saharan

Africa’s leading countries, hosts a larger number (21 projects) of relatively smaller projects worth a total of $3.3 billion. Similarly, Ghana is home to 18 projects worth $2.2 billion.

Key Stakeholders

Public entities such as the Saudi Water Partnership Company, the Zululand District Municipality, and Qatar General Electricity and Water Corporation represent most of the major developers. However, several desalination projects are being developed by privately owned stakeholders. Large international financiers and development banks have identified the developmental and environmental impact of the sector. Hence, the African Development Bank, World Bank Group, as well as European development banks such as KfW, EIB, and the French Development Agency are providing significant amounts of financing. Leading contractors in MEA’s water sector include Orascom, Bioui Works, SEPCO, and Hassam Allam.

Conclusion – Opportunities in Water Projects in Africa and the Middle East

For product and service providers, large-scale water projects in Africa and the Middle East provide significant opportunities. If you would like to explore more about projects in your region, market, or area of interest, sign up for ABiQ’s Free Trial or contact us at info@abiq.io. To read more blog posts about ABiQ’s key sectors, explore our articles about power, infrastructure, building construction, extractive industries, water.