Africa Projects Outlook

Economic activity in Africa has been rapidly expanding over recent decades. The IMF predicts growth on the continent to accelerate further in upcoming years, from 3.5% in 2024 to 4.3% in 2029. With a large, young, and growing population, many African countries are benefiting from an expanding labour force, while much of the rest of the world is aging.

Consequently, the Africa projects market is booming with opportunities. On ABIQ’s unique business intelligence platform, we track over 3,000 active investment projects and business opportunities worth over $3 trillion in Africa. These include sectors such as buildings, industrial plants, oil and gas, mining, power, transport infrastructure, and water.

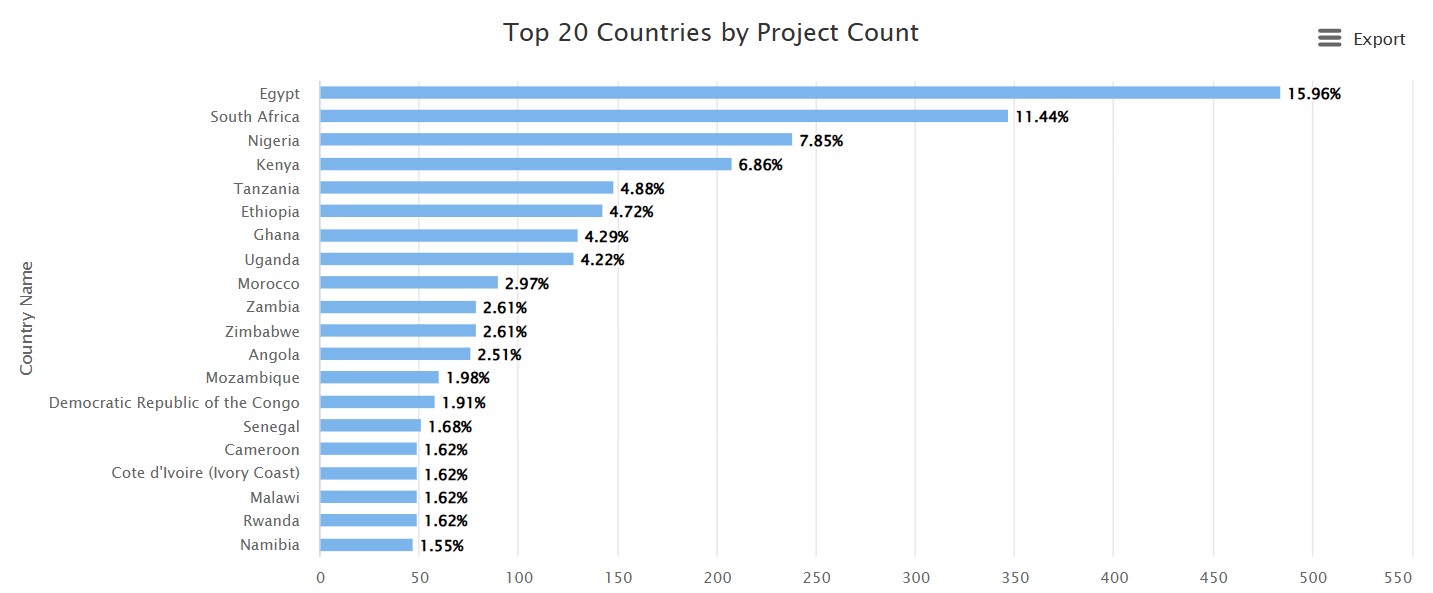

According to our data at ABIQ, West Africa leads the continent with projects worth more than $1 trillion, followed by North Africa with $930 billion. East Africa comes third with projects worth $750 billion. Egypt leads the project market with over 450 active projects worth $640 billion. With active projects worth around $402 billion, South Africa comes second, followed by Nigeria, which has ongoing and upcoming projects worth $330 billion.

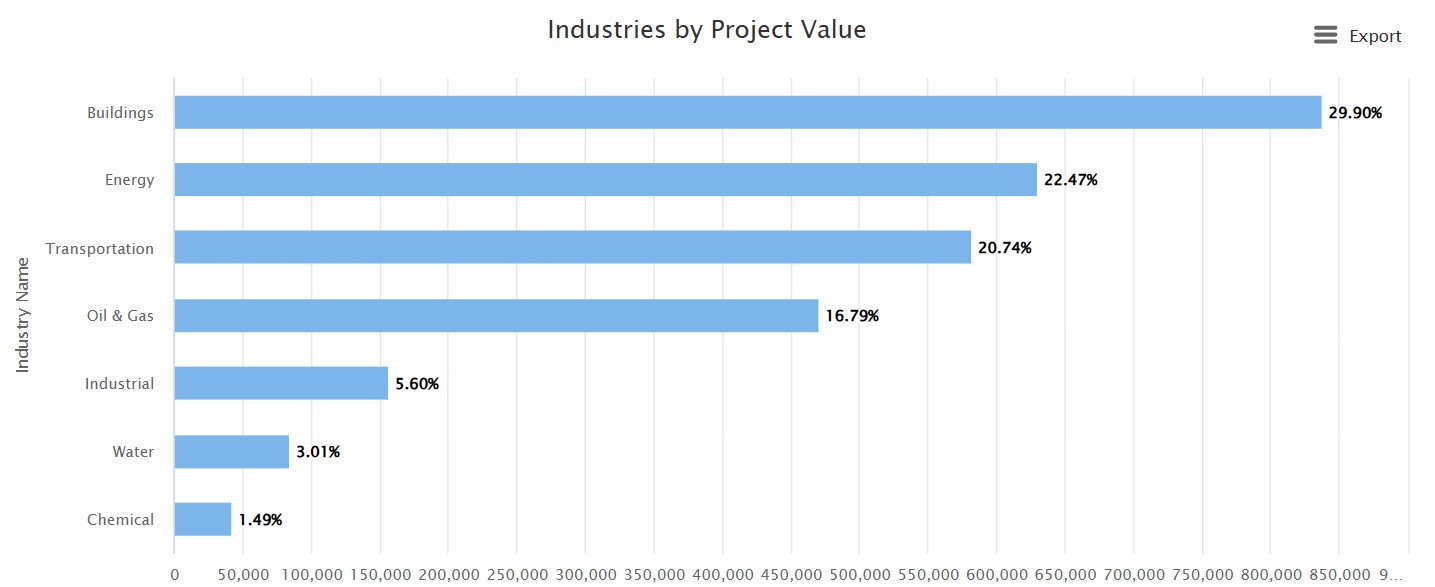

Buildings, such as housing, offices, health care, data centers, and educational facilities have been a focus of many countries to meet the needs and requirements of a growing population. Consequently, building construction is the largest sector with more than 850 projects worth approximately $840 billion. Energy has projects worth over $630 billion, followed by transport projects, which include roads, airports, and railways, worth more than $580 billion.

Why Africa Projects

Africa is a land of opportunities and the best time to invest in Africa is NOW.

Its population is set to increase by 25% over the next 10 years. It will grow from 1.340 billion in 2020 to 1.617 billion by 2030. This will result in a demand for more infrastructure and a huge market with lots of opportunities.

How can ABiQ help?

With Africa deeply embedded in our roots, ABiQ is committed to supporting the growth of the African economy. Africa is a land of opportunities and ABiQ can help you with your growth plans for the region.

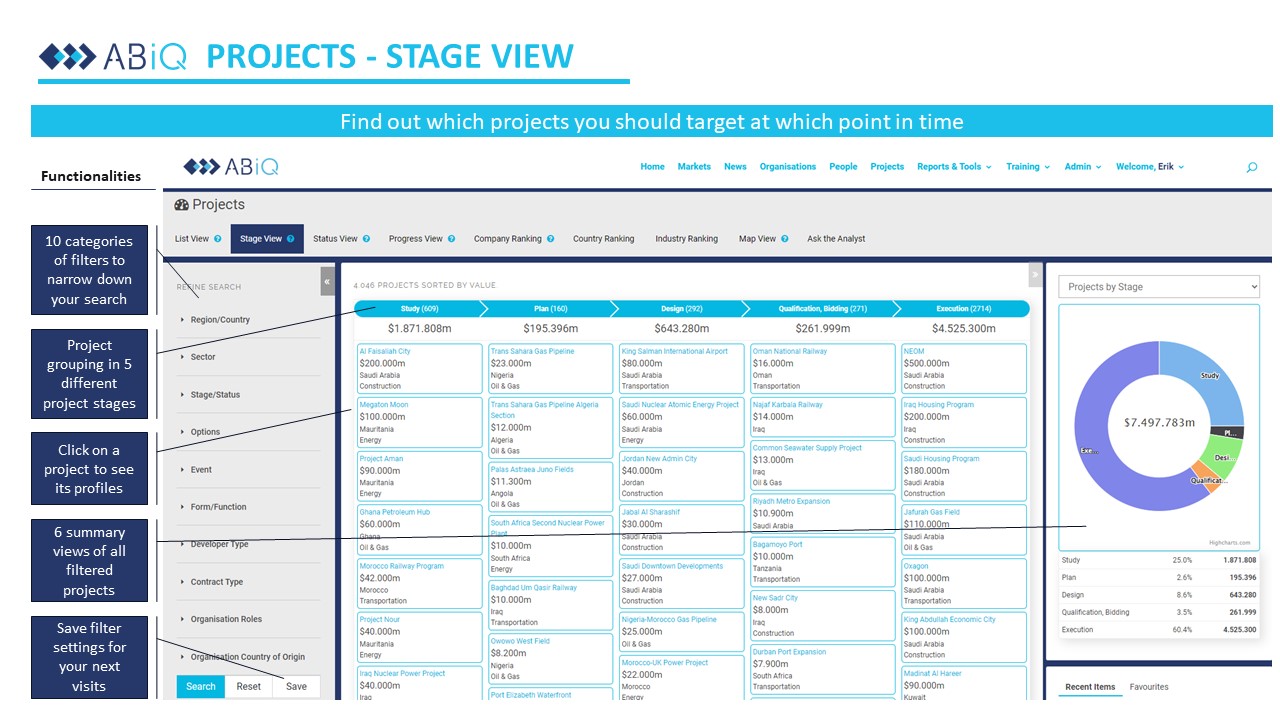

With our unique market intelligence and project tracking tool, you can:

- Track projects in Africa, UAE, and Saudi Arabia worth close to $7 Trillion

- Access over 15,000 companies involved in projects in Africa and the Middle East

- Access Company shareholders, subsidiaries, and detailed contact information

- Connect with decision-makers and grow your business in Africa and the Middle East

- Drive your growth strategy across all 54 African countries and key countries in the Middle East

Frequently Asked Questions

Here are some frequently asked questions about ABiQ.

What is ABiQ?

ABiQ stands for African Business Intelligence, and Intelligence Quotient. We are a leading business intelligence platform that tracks ongoing and upcoming projects in Africa and key countries in the Middle East.

Which industries do you cover?

We cover multiple industries, including transport infrastructure, energy/power, oil & gas, building construction, water, healthcare, and many others.

How do you get your data?

We have an experienced team of on-the-ground researchers located across Africa. They conduct primary and secondary research to provide ABiQ with up-to-date and validated data on Africa projects. We then verify all data before adding it to our platform. We follow a rigorous methodology of data gathering to grow and maintain our content.

How is ABiQ different from other platforms?

ABiQ is the only platform that offers validated data and trusted intelligence on all 54 countries in Africa. We have our ears and feet on the ground to provide you with opportunities worth trillions of US Dollars.

Is it a free service?

No, this is a paid subscription service. Get in touch, and we can suggest the package that suits you the best based on your requirements.

Can I get a trial?

You can access a light version of our platform by signing up for our Free Trial. Or contact us now to schedule a live demo of the platform.

Sectors we cover

Infrastructure projects in Egypt

Discover some of the largest infrastructure projects in Egypt and the potential they offer. Learn about the factors driving the industry.

Top 5 Hospital Construction Projects in Africa

Learn about some of the largest hospital construction projects in Africa driving healthcare infrastructure development.

Top 10 solar projects in Africa

Learn about the potential of solar projects in Africa and the challenges and opportunities for global suppliers.

Top 3 Transformative Ghana Construction Projects

Ghana construction projects are rapidly transforming the landscape, driving economic growth, and presenting lucrative opportunities for investors. As the country continues to urbanize and modernize, keeping track of these developments is crucial for stakeholders in...

Top 5 Kenya Infrastructure Projects in 2024

Discover the leading infrastructure projects in Kenya that are shaping the nation’s landscape and fueling economic development.

Top 10 construction projects in the UAE

Discover the top 10 UAE construction projects that are shaping the future of the region’s skyline and economy.

Harnessing the Tanzania Renewable Energy Potential: Industry Overview and Leading Projects

Explore the landscape of renewable energy projects in Tanzania. Learn about the key drivers behind the sector’s significant expansion.

Unveiling Opportunities in Saudi Arabia Construction Projects: Spotlight on Al Manar Community and ROSHN Asir

Discover the impressive construction projects in Saudi Arabia, such as the Al Manar Community and ROSHN Asir.

Infrastructure development: Top 3 road construction companies in Nigeria

Discover the leading road construction companies in Nigeria driving the country’s infrastructure development.

South Africa Power Plants: 3 Upcoming Projects

Explore opportunities in three of the largest upcoming South Africa power plant projects, which include renewable, hydrogen and gas plants.